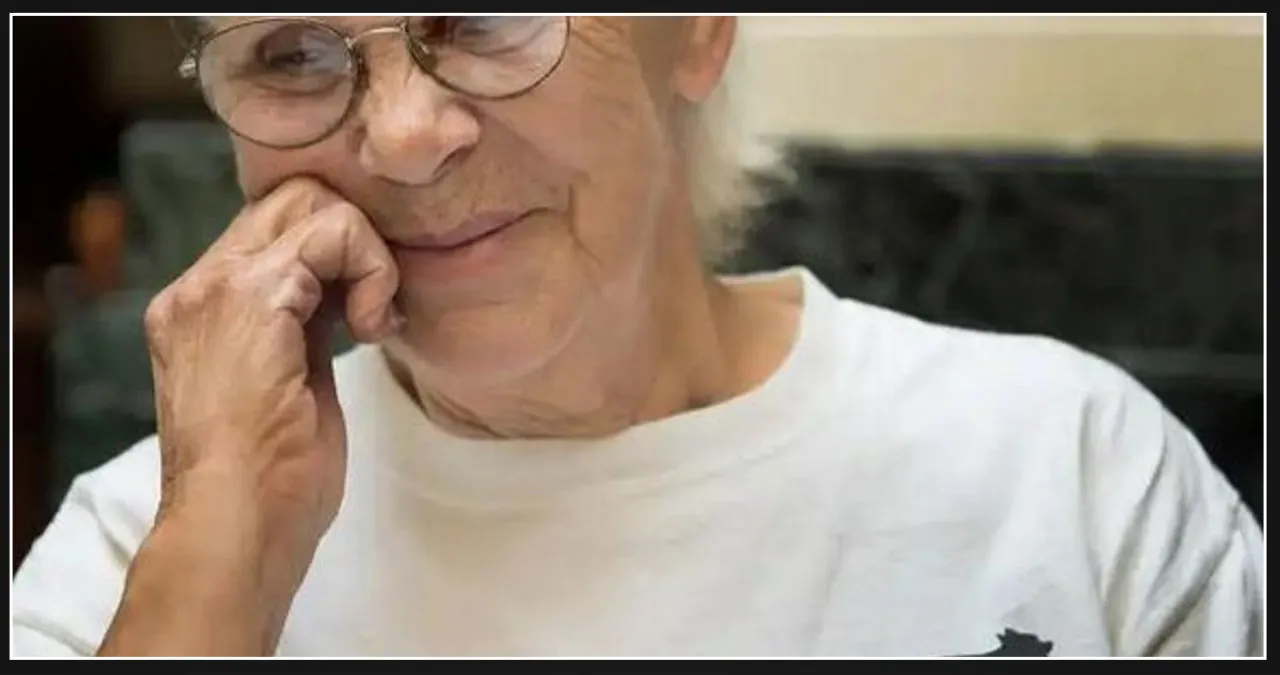

After enduring 16 difficult years of homelessness on the streets of Washington, D.C., an 80-year-old woman has finally been granted the $100,000 she believed she was entitled to from Social Security.

Wanda Witter’s story was met with skepticism and she was often labeled as “crazy” by those who heard it. However, her unwavering determination has finally paid off, putting an end to the years-long struggle.

The article includes one gallery with a count value of 1.

Witter spent nearly twenty years living near a McDonald’s, making the streets her home.

The woman had only three suitcases that held all of her belongings and important documents.

She shared her story with anyone willing to listen, recounting the unfortunate situation of her missing Social Security payments. However, her claims were often brushed off as mere tall tales.

Witter told The Washington Post that people continuously doubted her sanity and urged her to dispose of the suitcases.

Fortunately, Ms. Witter’s luck turned around when social worker Julie Turner made the decision to trust her story.

Attorney Daniela de la Piedra, from Legal Counsel for the Elderly, confirmed what Witter had always believed when Turner introduced them.

She was indeed correct about her claims.

Witter’s descent into homelessness started when she was let go from her job as a machinist in Corning. She then relocated to Colorado to live with her daughter.

After longing for a new beginning, she decided to enroll in paralegal classes and successfully completed the program after three years.

Things took a turn when she relocated to Washington, D.C. in search of paralegal work.

During the years 2006 to 2008, the Social Security checks she received were inconsistent and contained incorrect amounts.

Witter tirelessly fought to have the errors corrected and promptly returned the checks marked “void”.

Witter found herself homeless and in dire financial straits, despite her family’s offers of help.

Despite the mistake made by the Social Security Administration, the woman held steadfast in her belief that her situation would eventually be resolved.

Instead, mental health counselors were assigned to her, dismissing all of her claims as delusions.

TIME FOR CHANGE

This Article Includes

In May 2016, Turner accompanied Witter to Legal Counsel for the Elderly, where her lawyer verified the validity of her claims.

In June of that year, Witter was delighted to receive a check for $999, which was the maximum amount that Social Security could provide at that time.

Despite her victory, she still faced ongoing challenges.

As Witter awaited the rest of her payments, she found herself in a distressing situation – she was attacked by a homeless man.

Witter’s complete payments are now in the process of being processed, and she has successfully relocated to her own apartment, where she is responsible for paying a monthly rent of $500.

According to Turner, what she required was financial assistance, not psychiatric support.

“In D.C., one of the challenges with homelessness is that many cases are often attributed solely to mental illness. However, it is important to recognize that homelessness can also stem from economic factors.”

Witter’s story sheds light on the challenges individuals often encounter when faced with system failures.

The transformative power of persistence and not giving up is also highlighted in this case.

Ms. Witter has finally been vindicated and is now off the streets, living in a new apartment. We are hopeful that all the issues she faced will be completely rectified.

How to Supplement Your Social Security

HOW TO SUPPLEMENT YOUR SOCIAL SECURITY

Looking to supplement your Social Security income? Here are some effective strategies to consider:

With the future of Social Security in question, it is crucial for individuals to explore options to enhance their retirement savings.

According to Shannon Benton, the executive director of the Senior Citizens League, it is advisable to begin saving for retirement as early as possible and to consider investing in retirement accounts such as 401(k)s or IRAs.

-

- 401(k) Plans

- A 401(k) is a retirement account offered through employers, where contributions are tax-deferred.

- Many employers also match employee contributions, typically between 2% and 4% of salary, making it a valuable tool for building retirement savings.

- Maxing out your 401(k) contributions, especially if your employer offers a match, should be a priority.

- 401(k) Plans

-

- A 401(k) is a retirement account offered through employers, where contributions are tax-deferred.

- Many employers also match employee contributions, typically between 2% and 4% of salary, making it a valuable tool for building retirement savings.

- Maxing out your 401(k) contributions, especially if your employer offers a match, should be a priority.

-

- IRAs

- An Individual Retirement Account (IRA) offers another avenue for retirement savings.

- Unlike a 401(k), an IRA isn’t tied to your employer, giving you more flexibility in your investment choices.

- Contributions to traditional IRAs are tax-deductible, and the funds grow tax-free until they are withdrawn, at which point they are taxed as income.

- IRAs

-

- An Individual Retirement Account (IRA) offers another avenue for retirement savings.

- Unlike a 401(k), an IRA isn’t tied to your employer, giving you more flexibility in your investment choices.

- Contributions to traditional IRAs are tax-deductible, and the funds grow tax-free until they are withdrawn, at which point they are taxed as income.

Leave a Reply