New York’s request to create a new tax that is projected to generate billions of dollars in additional Medicaid reimbursement funds for the state has been approved by the federal government, announced budget officials on Monday.

In the beginning of this year, the state Legislature requested a federal waiver to levy taxes on Managed Care Organizations that the state Health Department funds for Medicaid. This request was made as part of the budget deal totaling $239 billion. State leaders applied to the Centers for Medicare & Medicaid Services in order to establish a new funding mechanism for this tax.

In an official statement released on Monday, Kenneth Raske, the CEO of the Greater New York Health Association, revealed that Governor Kathy Hochul personally informed him that the federal agency has given the green light to the MCO tax.

“This significant development offers a way to achieve our two main objectives: eliminating healthcare disparities in vulnerable communities and addressing Medicaid underpayments to hospitals and other providers,” Raske expressed. “Entering the holiday season, I can’t imagine a better way to make progress.”

The association took down Raske’s statement a few hours later. Hochul has not made any public remarks about the approval yet.

The state Health Department confirmed the approval on Monday, but declined to provide details about the funding amount and timeline.

According to a statement from Health Department spokesperson Danielle De Souza, the department is currently reviewing the final approval. She mentioned that additional information will be provided in the future.

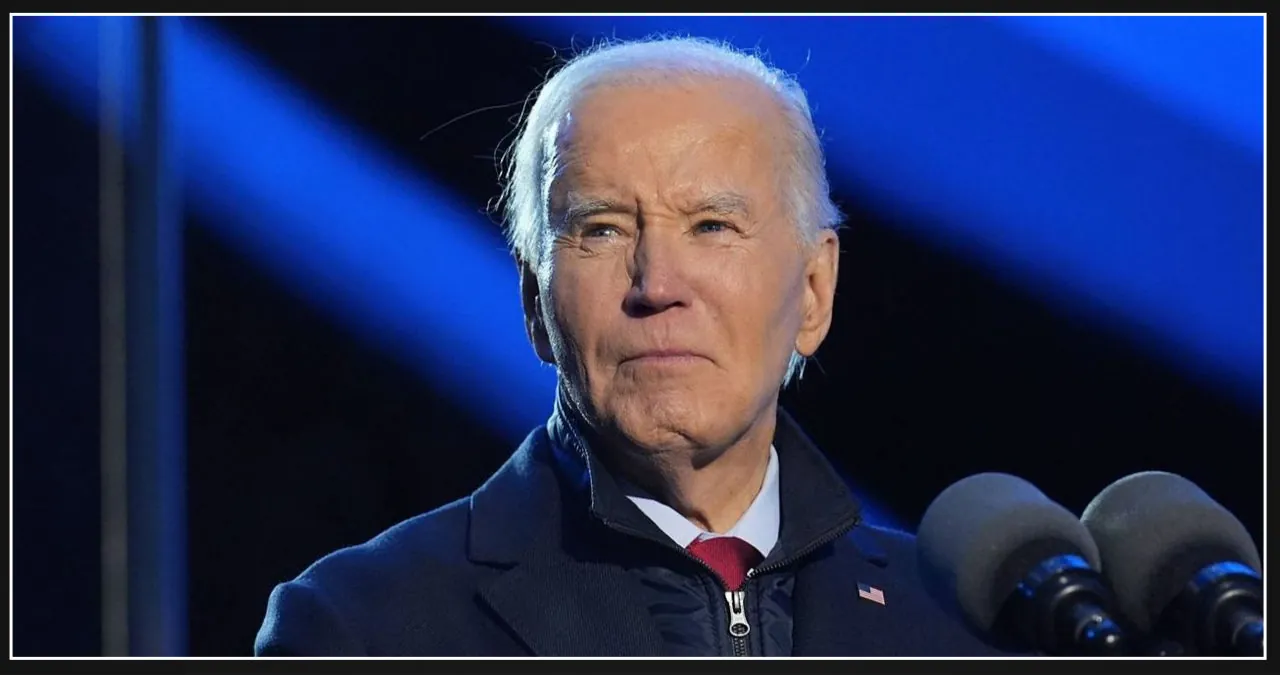

The fate of the approval is uncertain as President-elect Donald Trump prepares to take office on January 20.

The exact amount of revenue that the tax will generate for New York in comparison to other states has not yet been disclosed by state officials.

According to the California Department of Health Care Services, California implemented an MCO tax in April 2023, with an estimated revenue of $20.9 billion expected to be generated until its expiration on December 31, 2026.

During the summer, businesses and commercial health insurers in New York urged the governor to exempt them from the potential new tax, expressing concerns that its implementation could result in higher rates for both employers and employees.

Leave a Reply